Debt Combination vs. Debt Settlement: More Discussion Posted Here

Debt Combination vs. Debt Settlement: More Discussion Posted Here

Blog Article

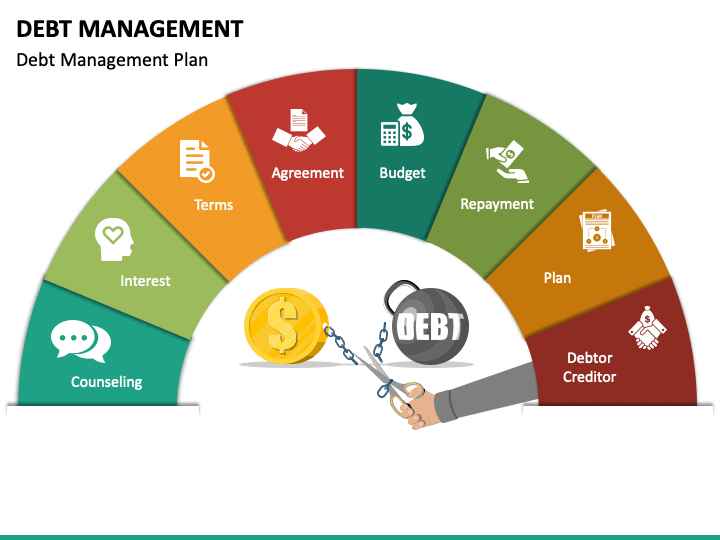

Understanding the Key Benefits of Executing a Financial Obligation Monitoring Strategy for Financial Security and Safety

Enhanced Financial Company

To accomplish improved monetary company, people have to prioritize creating a detailed spending plan that properly reflects their earnings and expenditures. A spending plan works as a roadmap for financial decision-making, allowing individuals to track their spending, identify areas for possible cost savings, and allot funds in the direction of vital costs, cost savings, and financial debt payments. By meticulously describing earnings sources and taken care of expenditures such as rental fee, energies, and loan payments, individuals can acquire a clear understanding of their monetary standing and avoid overspending. Moreover, budgeting enables individuals to set reasonable financial goals, whether it be constructing a reserve, conserving for a significant acquisition, or settling debt.

By maintaining track of bills, account statements, and crucial economic information in an orderly manner, people can easily check their monetary progression, recognize inconsistencies, and make educated decisions. Inevitably, boosted monetary company via budgeting and document monitoring lays a strong structure for economic security and success.

Decreased Rate Of Interest Rates

By strategically negotiating with lenders and exploring refinancing alternatives, people can function towards protecting reduced rate of interest prices to ease financial burdens and accelerate financial debt repayment. Minimized interest prices play a critical role in making financial obligation more cost-efficient and manageable for individuals looking for economic stability.

In addition, minimized rates of interest can cause substantial long-lasting financial savings, particularly on high-interest financial debts like charge card or personal finances. By combining debts or working out reduced prices with creditors, people can lower their general expense of loaning, inevitably boosting their economic wellness. In addition, reduced interest rates can assist people stay clear of dropping better right into financial debt, as high-interest payments can commonly prevent progression in getting rid of present financial debts. In general, protecting minimized rates of interest through a financial obligation management plan can provide individuals with an extra lasting course towards monetary safety and security and financial obligation freedom.

Consolidated Financial Obligation Payments

Consolidated debt payments enhance economic obligations by combining numerous debts into a single workable repayment, simplifying the payment process and possibly lowering general passion costs. This strategy can provide individuals with a more clear overview of their financial commitments, making it much easier to spending plan and strategy for payments.

Moreover, consolidated financial obligation repayments can assist enhance credit rating ratings by making certain prompt and regular payments. Battling or missing out on payments to keep an eye on multiple due dates can adversely impact credit rating scores. With a solitary, combined repayment, individuals are much less most likely to miss out on repayments, consequently enhancing their creditworthiness gradually. On the whole, combined financial obligation payments offer a efficient and practical means for individuals to manage their financial debts, reduce economic anxiety, and job towards attaining higher monetary stability and safety and security.

Expert Financial Advice

Navigating the intricacies of financial administration frequently requires seeking specialist guidance to make click resources sure enlightened decision-making and tactical preparation for long-term stability and success. Professional economic assistance can supply individuals with the experience and support needed to browse difficult economic situations successfully. Financial counselors or consultants can offer tailored recommendations based on an individual's particular scenarios, aiding them understand the implications of their monetary decisions and charting a path in the direction of economic safety and security.

One secret advantage of specialist economic support is the access to personalized financial techniques. More Discussion Posted Here. These experts can examine an individual's financial situation, create an extensive plan to deal with financial obligation monitoring concerns, and give recurring assistance and surveillance. Additionally, economists can offer understandings on budgeting, conserving, and investing, encouraging people to make audio economic selections

Improved Credit History

Seeking specialist financial assistance can play an essential duty in boosting one's credit history rating and total financial health and wellness. By functioning with monetary professionals, people can find out effective techniques to handle their debts properly, make prompt repayments, and bargain with financial institutions to potentially reduced interest rates or waive fees.

A financial obligation administration strategy can additionally aid in settling several debts into one convenient monthly payment, which can avoid missed payments that adversely affect credit history - More Discussion Posted Here. Furthermore, by adhering to the organized settlement plan detailed in the debt management program, individuals can show economic responsibility to credit scores reporting agencies, leading to steady renovations in their credit report in time

Final Thought

In conclusion, implementing a financial debt administration plan can provide improved financial company, decreased passion prices, combined financial obligation repayments, specialist economic guidance, and boosted credit rating. By following a structured strategy, individuals can much better handle their financial debts and job towards financial stability and safety and security. It is crucial to consider the benefits of a debt monitoring plan in order to enhance one's general monetary health.

In general, combined debt settlements use a practical and effective way for individuals to manage their financial obligations, reduce financial anxiety, and job in the direction of achieving higher financial stability and safety.

Specialist economic guidance can provide people with the experience and assistance needed to navigate challenging financial circumstances efficiently. Financial advisors or therapists can provide tailored guidance based on an individual's details circumstances, helping them understand the effects of their financial choices and Read Full Report charting a course click for source in the direction of economic security.

Additionally, economic experts can offer insights on budgeting, conserving, and investing, encouraging people to make sound financial choices.

In conclusion, implementing a debt monitoring strategy can supply improved monetary organization, minimized interest prices, consolidated financial obligation repayments, expert monetary guidance, and improved credit report rating.

Report this page